Which of the Following Is Not an Asset Utilization Ratio

Low inventory levels C. A company with a high asset turnover ratio operates more efficiently as compared to.

Asset Turnover Ratio Formula And Excel Calculator

Which of the following is not an asset utilization.

. An increase in asset utilisation indicates that the firm is getting more value out of each dollar of its assets. The asset utilization ratio calculates the total revenue earned for every dollar of assets a company owns. Debt to total assets ratio is a debt utilization financial leverage ratio.

The key metrics involved in the calculation of asset utilization. Fixed asset turnover C. Rapid turnover of assets D.

Times interest earned C. For the purposes of this course we will discuss three asset utilization ratios Inventory Turnover Average Collection Period and Total Asset Turnover see below. Wrong - Your answer is wrong.

For Amalgamated Hat Rack in 2016. Which of the following is not an asset utilization ratio AnswerAnswer to the following question is as followsExplanationThe asset utilisation ratio determines how much income a firm earns for every dollar of assets it possesses. O Increase as its debt-to-assets ratio decreases.

School University of Hawaii West Oahu. According the DuPont system which of the following is not a factor in achieving a satisfactory return on assets. The asset utilisation ratio determines how much income a firm earns for every dollar of assets it possesses.

Terms in this set 15 The most rigorous test of a firms ability to pay its short-term obligations is its. B Return on assets. C Fixed asset turnover.

Ability to use its assets to generate sales. Examination of assets management ratios shows how proficiently and successfully an organization utilizes its resources to produce income. Production processes can.

D The requirement is to identify the ratio that does. The asset turnover ratio formula is equal to net sales divided by the total or average assets. In examining the liquidity ratios the primary emphasis is the firms.

This ratio is frequently used to compare a companys efficiency over time. O Decrease as its current ratio increases. Types of Assets Common types of assets include current non-current physical intangible operating and non-operating.

Ratio analysis can be useful for. Which of the following is not an asset utilization ratio A Inventory turnover B. Pages 158 Ratings 91 22 20 out of 22 people found this document helpful.

Asset-utilization ratios are used to determine the profitability of everything from inventory to accounts receivable sales and total asset turnover. All of the options are true. There are also specialized ratios that deal with such issues as sales returns repairs and maintenance fringe benefits interest expense and overhead rates.

Return on assets investment 17. Total asset turnover indicates the firms. The calculation of asset utilization ratio involves four main metrics as well as several situational ones.

This metric is commonly used to compare the effectiveness of a company over tenure. Which of the following is not an asset utilization ratio. The type of ratio that allows the analyst to measure the ability of the firm to earn an adequate return on sales total assets and invested capital is.

A short-term creditor would be most interested in A. Asset turnover ratio measures the value of a companys sales or revenues generated relative to the value of its assets. Course Title FIN 307.

A conservative company experiencing rapid price increases for its products. Financial Statement Analysis under IFRS. What is Asset Utilization Ratio.

If ABCs sales are 1000000 while accounts receivable is 100000 inventory is 45000 and fixed assets are 132000. 0 Measure how much cash is available for reinvestment into current assets 0 Measures the companys ability to generate a profit on sales. Asset utilization is a ratio used by business analysts to determine how well a company is using its available assets to generate a profit.

Return on equity D. The main factors are discussed below. Debt to total assets Debt to total assets ratio is not a measure of asset utilization because asset utilization ratios provides measure of the ability of a companys management in making best use of its assets for generating revenues.

They demonstrate the capacity of an organization to change over its resources into deals. Not measure asset utilization. Asset utilization ratio s measure the efficiency with which the firm uses its asset s to generate sales revenue to reach a sufficient profitability level.

Which of the following is not an asset utilization ratio. Your result will be a number rather than a dollar amount. Which of the following is not an asset utilization.

1 point Asset utilization ratios O Relate balance sheet assets to income statement sales. Answer d is correct because the. Assets management ratio is otherwise called resource turnover rates and resource productivity proportions.

Use of debt B. The Asset Turnover ratio can often be used as an indicator of the. Return on assets B.

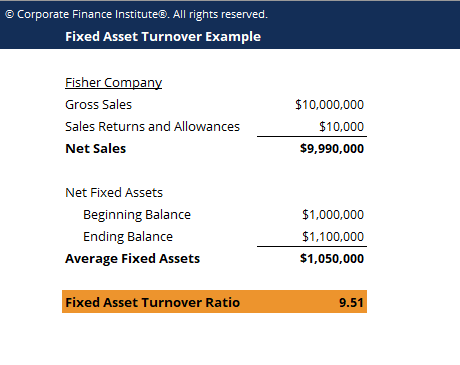

Continuing with the previous example if a company had net sales of 10000000 and 8000000 in average assets they would have an asset turnover of. A plethora of diverse factors can affect the overall asset utilization in an organization. Find more terms and definitions using our.

Which of the following is not considered to be a profitability ratio. Solve your equation by dividing net sales by average total assets. Which of the following is an asset utilization ratio.

Answers a b and c are incorrect because they are. The ratios and formulas utilized for the asset utilization of a company include Sales to Working Capital Ratio Sales to Fixed Assets Ratio Sales to Administrative Expenses Ratio Sales. Divide to get asset utilization.

An increase in asset utilisation indicates that the firm is getting more. The higher the utilization ratio of any given asset the. Return on equity D.

Click to see full answer. D Average collection period. The correct answer is option 4.

An increasing asset utilization means the company is being more efficient with each dollar of assets it has. Average collection period D.

What Is The Debt To Total Assets Ratio Bdc Ca

Fixed Asset Turnover Template Download Free Excel Template

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

No comments for "Which of the Following Is Not an Asset Utilization Ratio"

Post a Comment